The seductive promise of Vietnam’s pork sector

It’s easy to be interested in Vietnam if you are into pigs. The country is one of the world’s top ten producers of pigs and pork, it has the world’s fifth largest pig inventory and its pigmeat production is sixth on a global scale. What more is known?

Vietnam has a population of around 93 million people with, according to official reports, an average pork consumption of about 20 kg per capita. Furthermore, per capita incomes are rising along with a trend towards urbanisation and modernisation of agriculture and the government has an official target of securing another 10 million pigs in the herd by 2020 (+30% on the 2013 level). What’s not to like?

There appears to be opportunities everywhere for those who have a commercial interest in producing and selling pork. Hence, it’s very easy to make a case for spending more than a little time trying to understand what’s happening in the Vietnamese pig industry and working out if and when the promises implied by these simple statistics might deliver some serious business (albeit with unreliable official data).

Productivity challenge

Table 1 confirms Vietnam as the world’s sixth largest pig producer but immediately highlights one of the country’s challenges – productivity. It may be the sixth largest producer in terms of global pigmeat production but the country needs 26 million pigs to achieve this whereas Germany manages to produce more than half as much pigmeat again from a domestic herd inventory that is about the same size as Vietnam’s.

One recent estimate suggests that the average number of finished pigs per sow in Vietnam is 12.3 pigs per sow per year (the same source estimates the performance of modernised pig farms in Vietnam at 20.5 pigs per sow per year). Note also that these figures do not take account of the ratio of muscle to fat that is probably much lower in Vietnam’s average carcass profile.

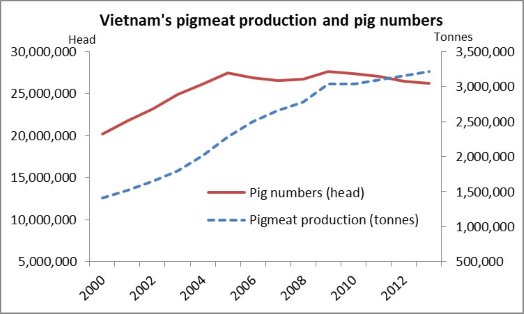

Lower productivity stems from a mix of the key factors that are familiar to all livestock and supply chain specialists: inferior genetics, extensive disease (you name it and Vietnam has had it or has it now – PRRS, FMD, CSF, etc.), inadequate biosecurity, poor feed conversion ratios and fertility/sow management, and inefficient slaughtering and processing operations. Figure 1 however, shows a slight turnaround in productivity with pig numbers dropping whilst a slight rise in pig meat tonnage is noted.

Changing profile

With an estimated two thirds of the population classified as farmers most of Vietnam’s pigs have been bred and finished in small herd sizes of one to five sows and less than 20 finishers, and most pigs are slaughtered in small scale butchers’ (home) premises. This peasant-scale aspect of Vietnam’s pig industry profile explains why productivity in the swine sector is low. But the profile is changing – fast. Vietnam’s economy is growing rapidly and the rate of urbanisation is reducing the rural population and the number of households with pigs at the same time as increasing per capita incomes and pork consumption. These trends guarantee a demand for improved management and modern inputs/processes for the pigmeat supply chain. That’s good news for anyone who is involved in delivering the supply side upstream of a pig unit. Clearly, there’s a lot to be done to bring Vietnam’s pig industry into the 21st century.

Two other aspects of Vietnam’s pig sector need mentioning. Firstly, it’s concentrated in two key regions – the Mekong Delta (about 15% of pigs and 18% of pork production) in the south and the Red River Delta (about 25% of the pigs and 33% of pork produced) in the north. It’s likely that these regions will be the focus of the restructuring and intensification of the domestic pig production.

Secondly, there were estimated to be as many as 10,000 modern or intensified pig farms in Vietnam in 2014 and these large scale commercial businesses provide about 15% of total pigmeat supplies. A typical model for such farms is based on the integration with feed mills with Thailand’s Charoen Pokphand Foods (CPF) leading the way in the use of this concept. San Miguel (Philippines) and Japfa (Indonesia) are two other integrators that have a presence. This integrated model has led to accusations that the feed mill operators are manipulating feed prices to make life difficult for the smaller farms in Vietnam. As well as technical inefficiencies it’s also clear that Vietnam’s marketing and price information systems are in drastic need of modernisation and improvement.

Growing pork consumption

The average consumption of pork per capita is reported to be 20.1 kg per capita per annum but this disguises a wide range of behaviour with urban dwellers having higher rates of consumption: one report puts consumption in Ho Chi Minh City at 25 kg per capita. To put this in context, Taiwan’s population eats, on average, about twice as much pork per head as is seen in Vietnam – so Vietnam has a way to go. Incidentally, the official data creates some confusion as reported production data for Vietnam which, if accurate, implies that domestic availability is already approaching 35 kg per capita per annum. Whatever the numbers, there is little doubt that Vietnam will have to produce more pork – or import it – in order to meet this growing appetite for protein.

Indeed, the World Bank expects that consumption will grow by nearly 8% per annum and this is a strong signal for investment in pork production (and import agents?) in Vietnam. Vietnam has relatively little international trade in pigmeat (in the official data at least) but just because this market is undeveloped now does not mean that it will always be like that. In 2012 pigmeat imports had a value of US$6.87 million – half as much as they were in 2011. Vietnam is expected to increase its import needs in the years ahead as domestic demand outstrips the capacity of the domestic supply chain. On the flip side, pork exports were worth US$60 million in 2012 (around 20% higher than in 2011). These overseas sales were mainly to Hong Kong (US$51 million) and this is a reminder that even with its poor animal health status Vietnam can still find export customers.

Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht