5 reasons why Brazil’s pig industry can be optimistic

Brazil’s pig sector has several reasons to celebrate despite the rough times it is in. At least 5 highlights in international meat trade can bring a little relief.

South Korea opens op

South Korea opens op

South Korea, the world’s 4th largest meat importer, announced the expected authorisation for Brazilian exports last week, after more than 10 years of negotiation. The country imported 645,000 tonnes of meat last year. No wonder it became the most important ‘goal’ for Brazil’s exporters, after having achieved similar permissions in China, Japan and US.

Read more on pig production in South Korea

Initially, free to sell are plants of Aurora, Seara, Brasil Foods (BRF) and Pamplona in the state of Santa Catarina. This region is recognised as ‘free of Foot-and-Mouth Disease (FMD) by the World Organization for Animal Health (OIE). One small downside – a tariff of 25% will still apply to Brazilian producers.

Peru welcomes Brazilian meat again

Peru welcomes Brazilian meat again

Several days ago, Brazil’s Ministry of Agriculture declared that Peru has also opened its markets for pig meat from Brazil. Nevertheless, some last details regarding an International Health Certificate have to be agreed on to allow business.

Peru has around 33 million inhabitants and shares a large border with Brazil’s north region. Both governments have been working together on economic, social and environmental issues.

Fish and the World Cup may soften Russia

Fish and the World Cup may soften Russia

Brazilian and Russian sanitary authorities met last April to discuss and solve the issue of a ban on Brazilian pork and beef to the Russian market. Since last December, Brazilian producers have not been allowed to export these products to Russia as allegedly ractopamine was found in the meat.

Read more on pig production in Russia

Rosselkhoznadzor, Russia’s sanitary authority, indicated the country would like to sell fish to Brazil. The upcoming football World Cup, held in Russia as from June, could help to accelerate discussions. Russia is important for Brazilian farmers, taking up around 7% of Brazil’s entire pork production.

The European Union might be summoned

The European Union might be summoned

Brazil is considering an appeal to the World Trade Organization (WTO) against the EU’s recent ban of Brazilian meat industries. The main concern here is poultry, but pig producers are keeping a close eye on the matter.

Blairo Maggi, Brazil’s minister of agriculture, stated that there are no technical reasons for the suspension. An appeal could, however, take a long time. Some specialists predict a strong decrease in poultry production. At least 5 BRF plants and Aurora have suspended their activities since April.

Re-opening of talks with China on more pork trade

Re-opening of talks with China on more pork trade

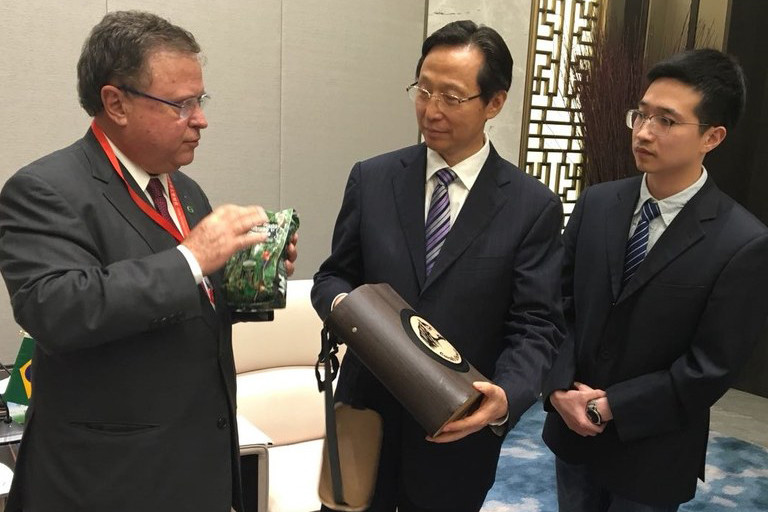

Last but not least, Mid-May, Mr Maggi was in Beijing to reopen talks with Chinese customs. One of the subjects involved the expansion of meat trade, including e.g. pork, gizzard, bone-in meat and thermically processed products.

The Chinese gave Mr Maggi the guarantee that the negotiations will be brought up in the Chinese Subcommittee on Inspection and Quarantine. About 2 years ago, Brazil and China suspended the cooperation in this subcommittee.

Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht