The remarkable dynamics of global pork production

Between 1970 and 2020, world meat production more than tripled, increasing from 101 million tonnes to 343 million tonnes. The increase has been very different for the 3 most important meat types: beef, poultry and pork. Welcome to a deep dive into 50 years of pig meat production at continental and country level.

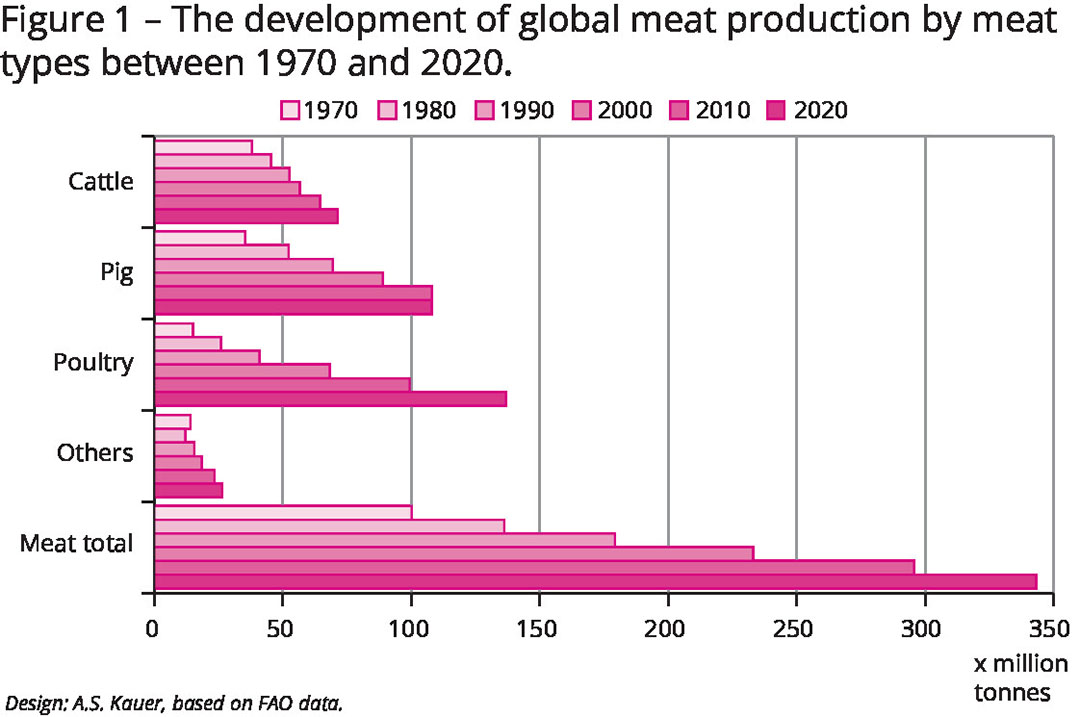

World meat production has developed dynamically between 1970 and 2020. Table 1 and Figure 1 show that it developed very differently for the 3 main meat types. In 1970, beef was in first place with a production volume of 38.3 million tonnes, ahead of pig meat with about 36 million tonnes. Poultry meat only reached 15.1 million tonnes and was still comparatively insignificant.

This distribution changed fundamentally in the course of the following decades. As early as 1980, more pig meat than beef was produced worldwide, and it was not until the last decade that poultry meat replaced pig meat as the predominant meat type. The stagnation of pig meat production is remarkable, as the production volume hardly changed between 2010 and 2020. Outbreaks of African Swine Fever (ASF) in several Asian countries and in Eastern Europe led to a drastic decrease in production. It was not until the beginning of the current decade that the production volume increased significantly again, reaching 120 million tonnes, whereby the gap to poultry meat narrowed considerably again.

Large differences in development

The large differences in the development of the meat types are due to various steering factors. On the one hand, production costs in intensive fattening differ considerably. Poultry has by far the best feed conversion rate and cattle the worst. In some religions, the consumption of pig meat, and in some also of beef, is taboo, which excludes more than 3 billion people as consumers.

In addition, pig meat plays an insignificant role in system gastronomy compared to beef and poultry. The lower production costs, the lack of barriers regarding consumption and the global spread of system gastronomy led to a doubling of poultry meat production between 2000 and 2020, while pig meat only increased by 86.7%. In recent years, the discussion about resource consumption has gained in importance alongside health aspects. This has led to stagnation or even decline in the consumption of pig meat in some European countries and in North America.

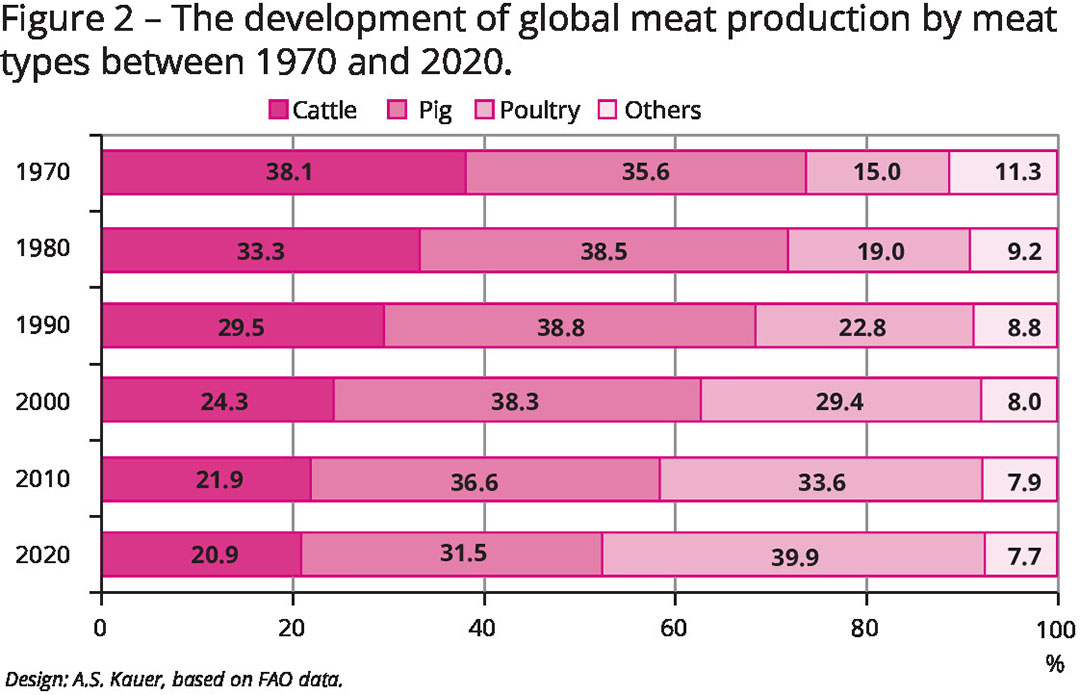

The remarkable change in the share of the meat types reflects a red to white shift in meat production and consumption (Figure 2). While beef lost 17.1% of its share and pig meat 4.1% between 1970 and 2020, poultry gained 24.9% and took an unchallenged leading position with a contribution of 39.9% to global meat production.

Considerable changes at continent level

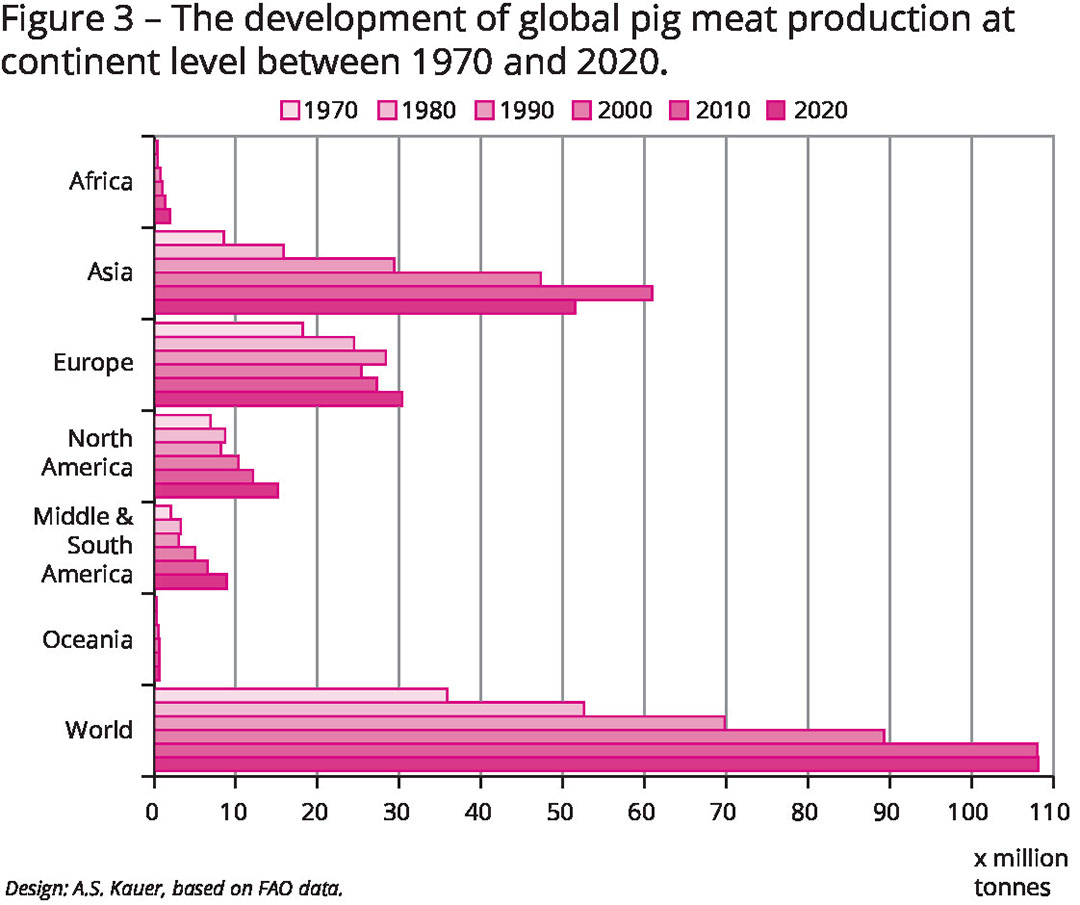

A closer look at the development of pig meat production at continental level shows that Europe held a leading position until well into the 1980s and was then replaced by Asia, which became the dominant continent in the following decades (Figure 3).

Due to the economic and political collapse of the Soviet Union and the dissolution of the Council for Mutual Economic Assistance (Comecon), pig meat production in Eastern Europe declined significantly and has only returned to the 1990 level in the last decade. Nevertheless, Europe was able to maintain its second place in global production and, in 2020, produced twice as much as North America. Central and South America experienced fast growth after 2000, with the decade between 2010 and 2020 being particularly dynamic.

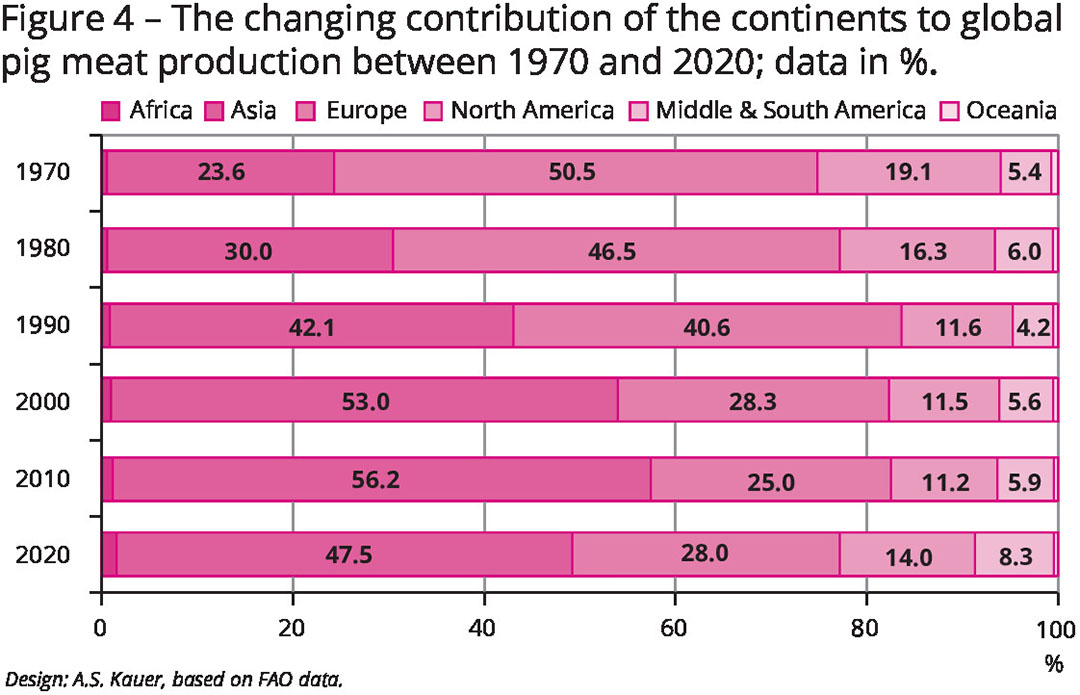

Asia contributed 59.3% of the 72.5 million tonne increase in pig meat production over the five decades analysed here, followed by Europe with 16.9% and North America with 11.5%. The highest relative growth rates showed Africa with 629.0%, Asia with 508.2% and Central and South America with 360.3%. The different developments in the continents resulted in a remarkable change of their shares in world production (Figure 4).

Europe’s contribution fell from 50.5% in 1970 to 28.0% in 2020, while Asia gained 23.9% overall and even 29.9% until 2010. The production decline of 9 million tonnes in the last decade, caused by outbreaks of ASF in several countries in East Asia, led to a temporary reduction in the share. North America’s share declined by 5.1% over the five decades analysed, while Central and South America gained 2.9%. Similar to the production of poultry meat, a shift in the regions with the greatest dynamics from Europe and North America to Asia and Central and South America is also evident in the case of pig meat.

Stabilisation of production at country level

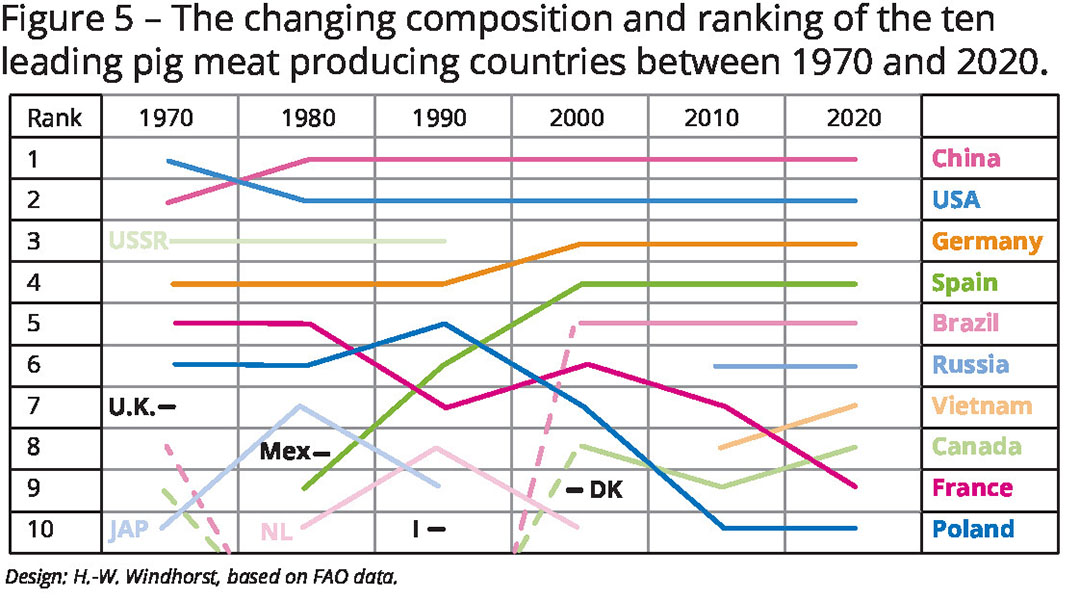

Figure 5 shows the composition and ranking of the ten leading countries in pig meat production between 1970 and 2020. While there was a considerable change in the composition of the countries and their ranking until 1990, except for China and the USA, a more stable situation emerged thereafter, indicated by the straight lines. The contrasting developments between Germany and Spain on the one hand, and Poland and France on the other are striking.

Brazil, after falling out of the top group between 1970 and 1990, has achieved a firm position in fifth place since 2000. Canada also shows similar dynamics. Russia ranked in sixth place in 2020. Worth noting is the rapid increase of Vietnam’s pig meat production since 2010. Denmark and the Netherlands were not able to maintain their positions in the top group, but this does not apply to their roles in trade, as will be shown in a second paper.

Regional concentration

The regional concentration in pig meat production increased from 71.2% in 1970 to 77.3% in 2010, then declined to 75.6% in 2020 before reaching 77.7% again in 2021. In 2000 and 2010 the 2 leading countries, China and the USA, accounted for more than half of global pig meat production, with China in a dominant position since 1990. The composition and ranking of the countries reflects the dynamics at continental level (see also Table 2).

For example, the growing importance of Central and South America is almost entirely due to Brazil’s strong increase in production. Asia’s dominant position is due to China, without which it would be far behind Europe and North America.

Germany lost its third place in 2021 to Spain, which has shown exceptional development since 1980; this was also reflected in the country’s position in pig meat trade.

An interim summary

The preceding analysis of the development of pork production in the period from 1970 to 2020 has shown that the 5 decades were characterised by remarkable dynamics. Production volume tripled over the 5 decades, reaching 108 million tonnes in 2020. Production grew particularly strongly in Asia, which accounted for 59.3% of the global increase of 72.5 million tonnes, followed by Europe and North America. Some countries in Central and South America also showed high production increases. Obviously, stable patterns in the composition and ranking of the leading countries formed in the past decade.

The OECD/FAO Agricultural Outlook to 2030 forecasts an increase in global pig meat production from 108 million tonnes in 2020 to 127 million tonnes in 2030. While a decrease in the production volume of 1 million tonnes is expected for Europe and only a slight increase of 400,000 tonnes for North America, the forecast shows an increase in production of 18.4 million tonnes for Asia and 800,000 tonnes for Central and South America. Production in Africa and Oceania will hardly change.

Despite rising sales, the market shares of meat substitutes will increase only slowly in the current decade; this applies to both plant-based products and meat from cell cultures. Continuing technical problems in the scaling up of production, high production costs and considerable consumer scepticism towards the great technical effort needed in production obviously prevent rapid expansion. Even towards the end of the current decade, only single-digit or low double-digit percentages are likely to be reached.

Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht