The remarkable dynamics of global pig meat trade

The first article in this series focused on the tripling of meat production between 1970 and 2020. Not surprisingly, with higher pig meat production levels, trade levels also changed considerably – even faster than production levels. And African Swine Fever outbreaks cause further boosts to trade.

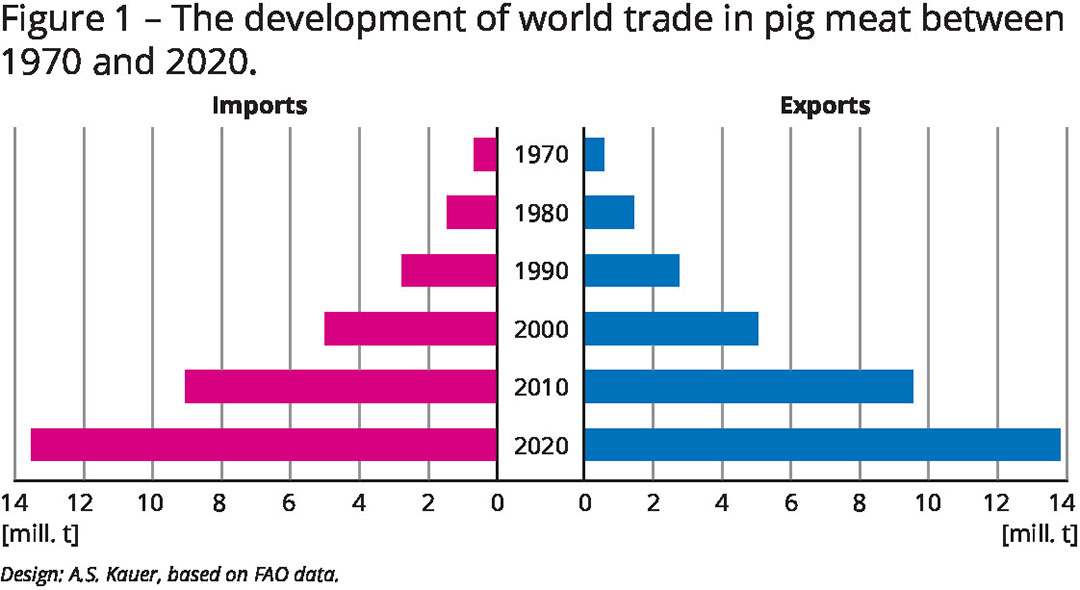

Between 1970 and 2020, global pig meat trade increased from 630,000 tonnes to over 13 million tonnes, a twentyfold increase. That number is derived from trade statistics of the UN’s Food and Agriculture Organization (FAO), on the categories “meat with the bone, fresh and chilled” and “meat boneless, fresh and chilled”.

As can be seen from Figure 1, trade volume has grown strongly since 2000, when each decade saw an increase of around 4 million tonnes. Table 1 shows the shares of each continent in exports and imports and the resulting trade balances. Europe, North America and Central and South America had positive balances in 2020, while the balances for Asia, Africa and Oceania were negative. Europe accounted for 63.4% of global exports, North America for 25.6% and Central and South America for 10.1%. Asia shared 46.5% in world imports, Europe 39.2% and Central and South America 8.1%. The data documents Europe’s particular position in the global pig meat trade.

Remarkable changes at country level

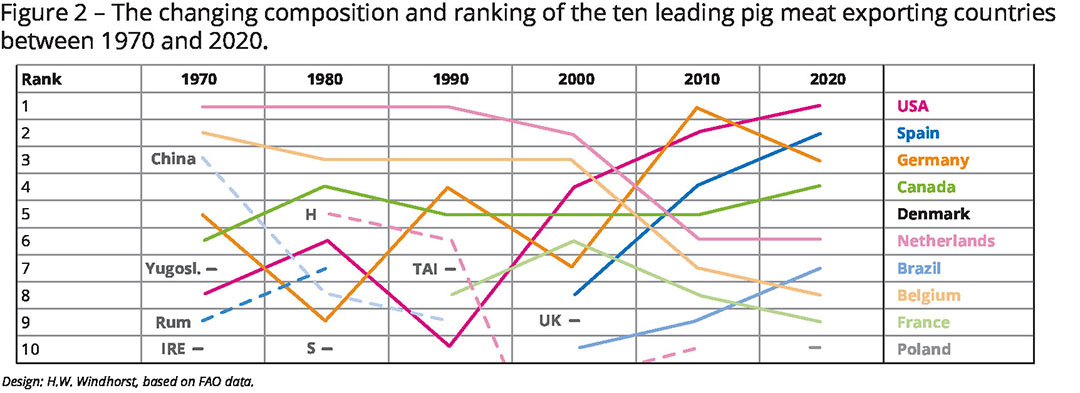

Figure 2 shows the change in the composition and ranking of the top 10 exporting countries. Until 1990, the Netherlands ranked in first place. In the following decades Denmark, Germany and finally the USA took the leading position. A closer look at the changes in the ranking of the countries shows the particular dynamics of Belgium, Germany and the USA. While Germany and Spain gained higher ranks since 2000, reaching second and third place after the USA, the Netherlands, Belgium, Denmark and France lost several places. Canada held a middle position over the entire period, while Brazil rose from tenth place in 2000 to seventh in 2020, due to the rapid growth of production.

Regional concentration in exports was extremely high. Until the 1990s, the top 10 countries accounted for over 90% of exports, after which this percentage declined slightly. Until 1990, the top 3 countries contributed over half to the export volume, then their share decreased to 45.1% in 2020. In 1970, 7 of the top 10 exporting countries were located in Europe and three in the Americas; this composition did not change until 2020, but the ranking of the countries changed (see Table 2).

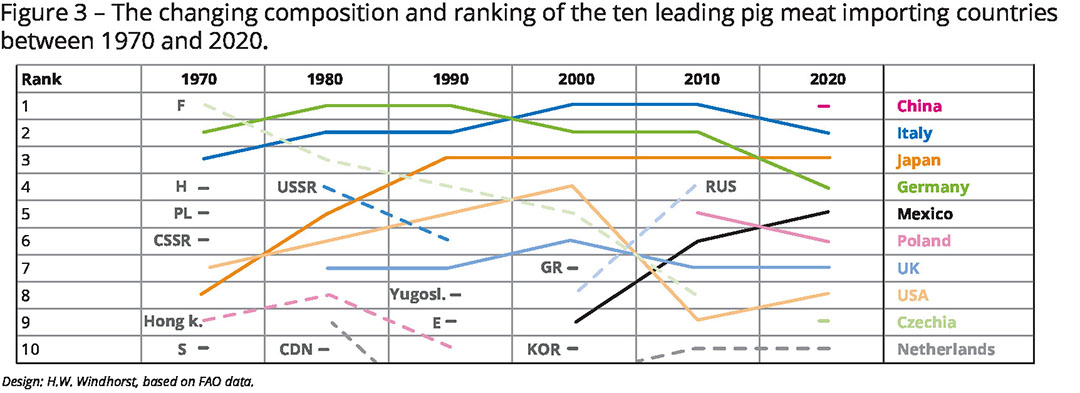

Figure 3 shows the remarkable dynamics in the composition and ranking of the top ten importing countries. Six European countries occupied high positions in 1970, led by France and Germany. 50 years later, there were still six European countries in the top group, but 2 Asian countries ranked in first and third place.

Italy, which had been the leading importing country in 2000 and 2010, fell to second place, while Germany, which had occupied first and second positions between 1970 and 2010, ranked fourth in 2020 behind Japan and ahead of Mexico, which became a major importing country in 2010. In 1970, Japan imported only 17,000 tonnes of pig meat. With an increase of its import volume by 875,000 tonnes, it showed the second highest absolute growth. China’s imports grew by 4.1 million tonnes between 2010 and 2020.

This exceptional increase was due to the devastating impacts of African Swine Fever outbreaks, which decimated herds and resulted in a drop of 9 million tonnes in production volume. It was not until 2020 that production increased to 53 million tonnes again. This caused pig meat imports to fall sharply, with drastic impacts on countries that had benefited from China’s high demand for several years, including Germany in particular.

The considerable dynamics in the composition and ranking of the leading importing countries is reflected in the significant changes in the regional concentration (see Table 3). The highest degree, of 91.7%, was in 1980, and the lowest, of only 62.5%, in 2010. The share of the three leading importing countries in total imports varied between 61.3% in 1970 and only 29.6% in 2010. It is obvious that, with the exception of China, imports were distributed more evenly in the past decade among the five following countries, which together accounted for 29.1% of global imports.

Summary and outlook

This analysis of pig meat trade between 1970 and 2020 shows that remarkable dynamics characterised the 5 decades. Pig meat trade increased much faster than production. In the period under consideration, it grew twentyfold and reached a volume of 13.5 million tonnes in 2020. In addition to the USA, several European countries took leading positions in exports. With regard to imports, Asia was in an unchallenged first place, mainly due to the high demand from China, but some EU member states and Mexico were also significant markets for the leading exporting countries. It is not yet clear how the sharp decline in Chinese imports will affect the composition and ranking of the exporting countries in the coming years. It will depend strongly on the epidemic events in East Asia and Eastern Europe, but also on the changing consumption behaviour of the population.

The OECD-FAO Agricultural Outlook 2023-2032 predicts that pig meat trade will decrease by 1.5 million tonnes. Exports from Europe, North America and also Central and South America will decline because imports from Asia will fall significantly due to lower imports from China.

Despite rising sales, the market shares of meat substitutes will increase only slowly in the current decade; this applies to both plant-based products and meat from cell cultures. Even towards the end of the current decade, only single-digit or low double-digit percentages are likely to be reached, and global trade of these products will still be insignificant.

Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht